- 333 Pierce Rd Suite 370, Itasca, IL 60143, United States

- customerservice@brightsideloans.com

- +1 (888) 708-0907

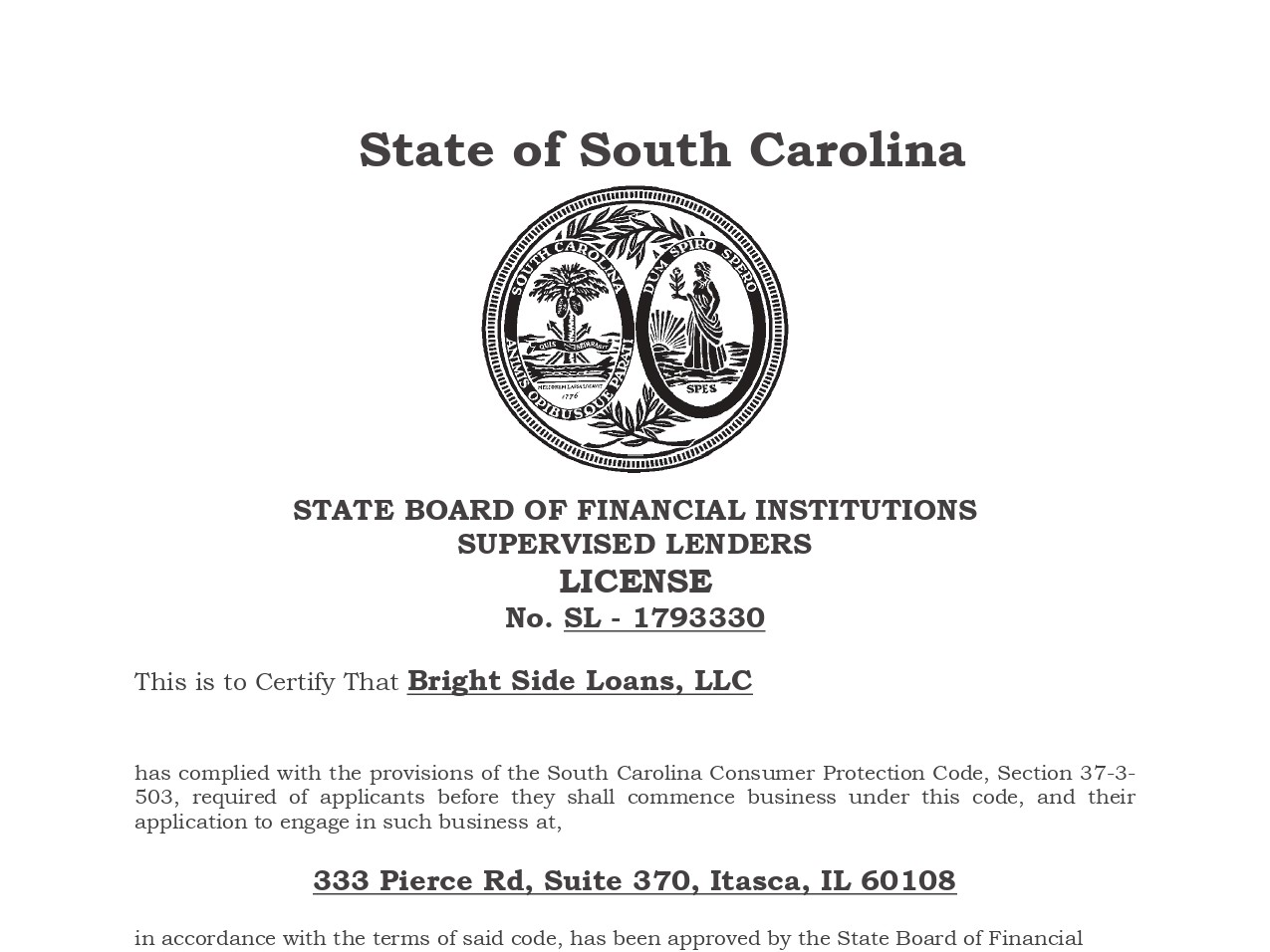

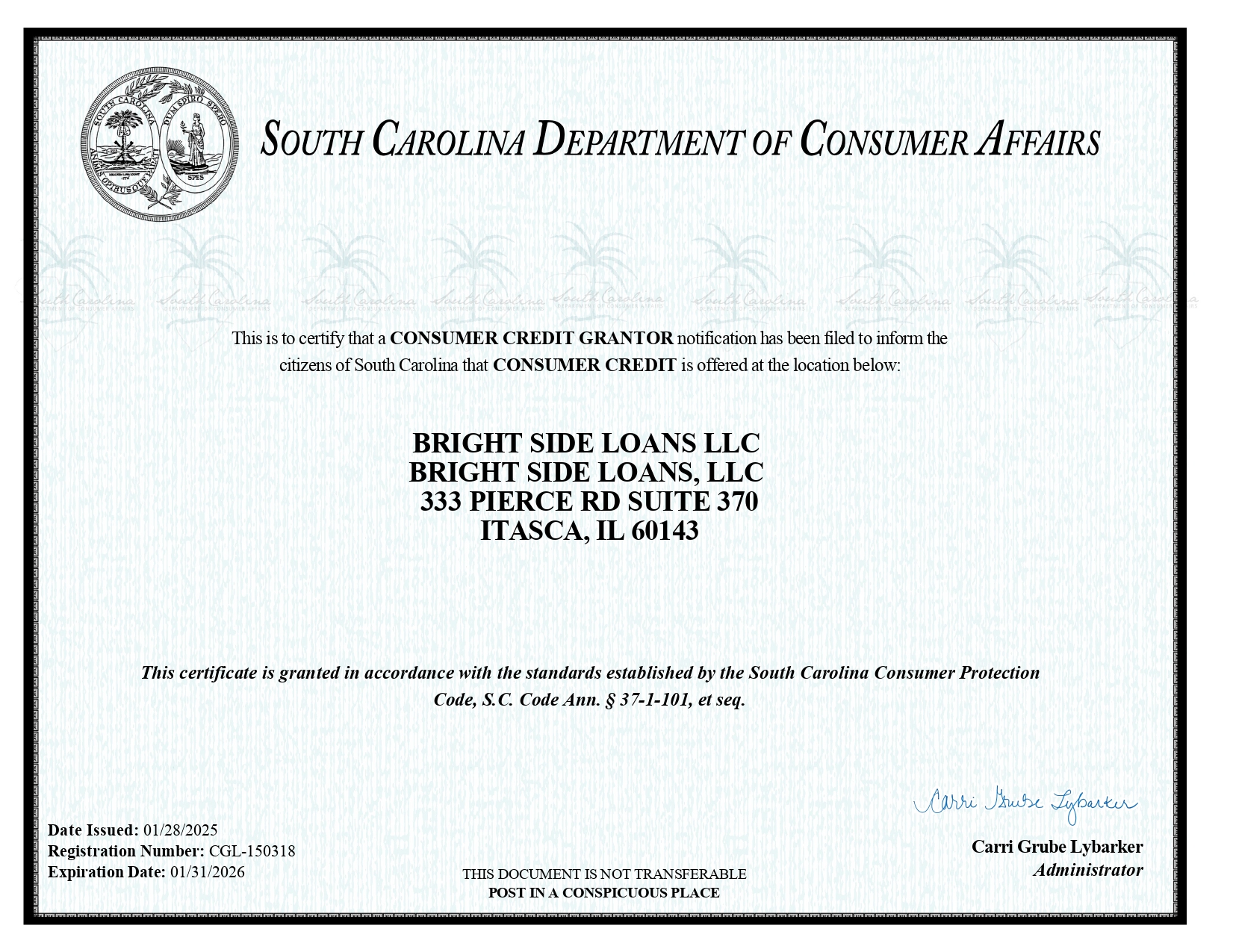

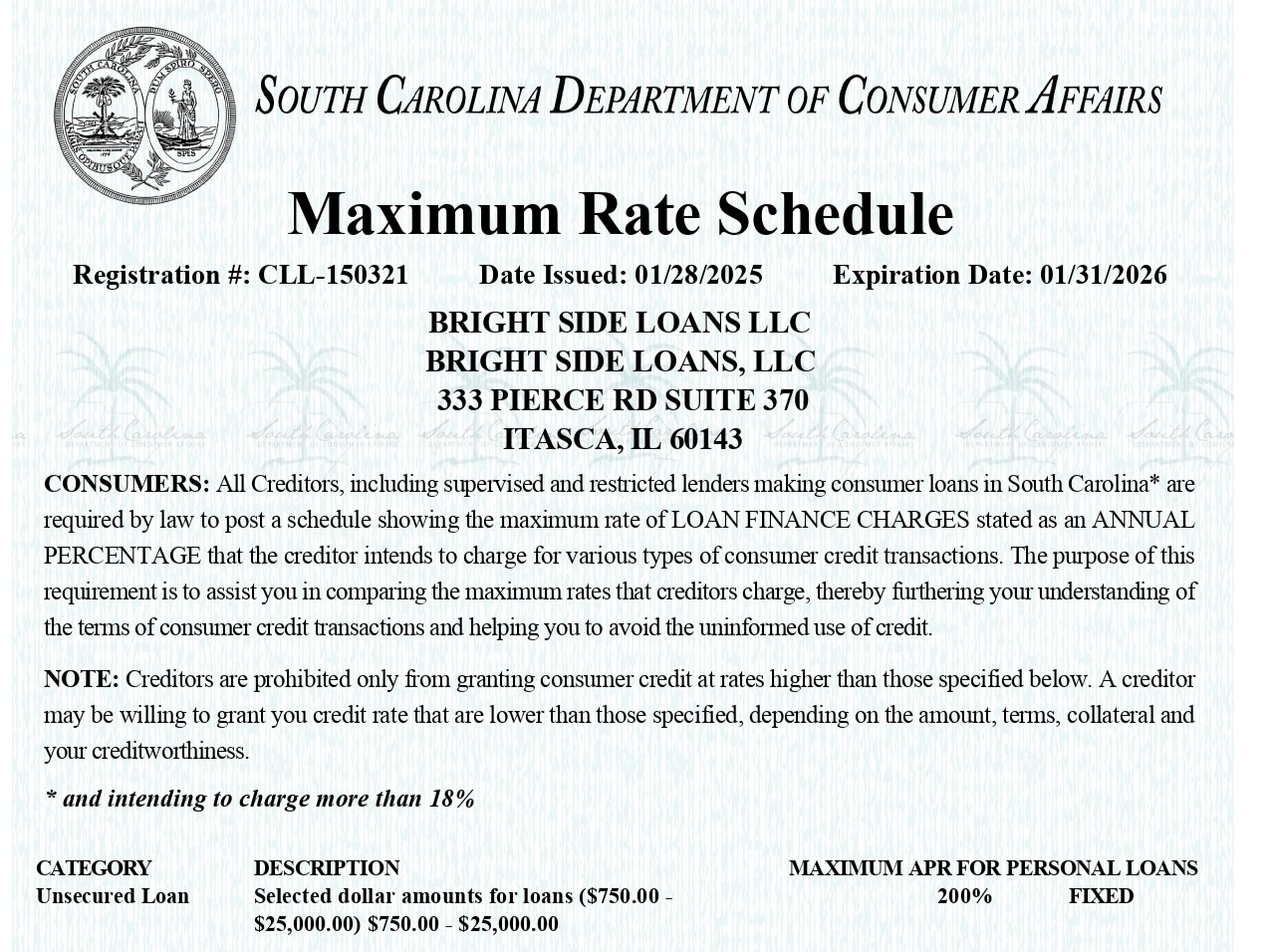

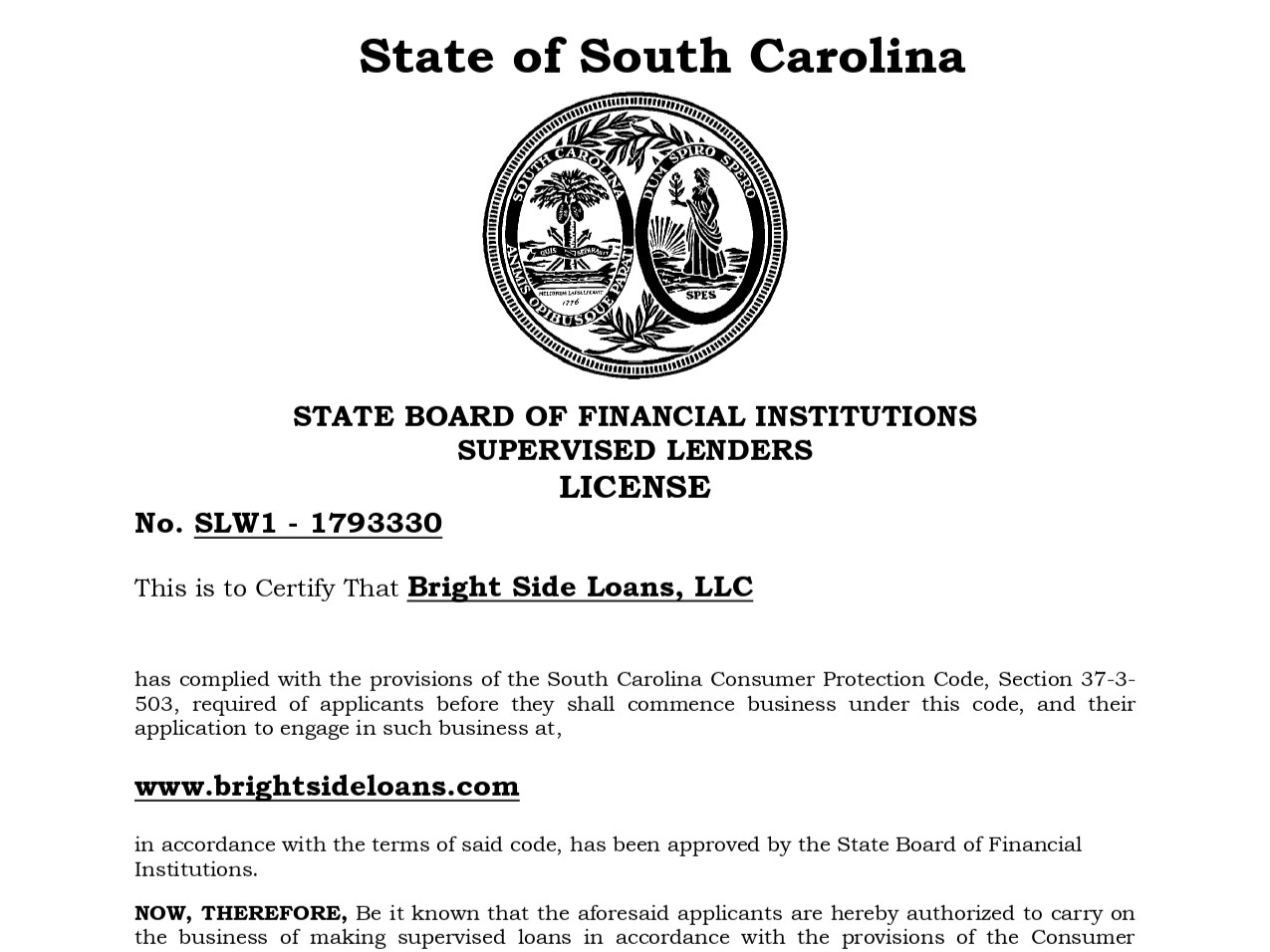

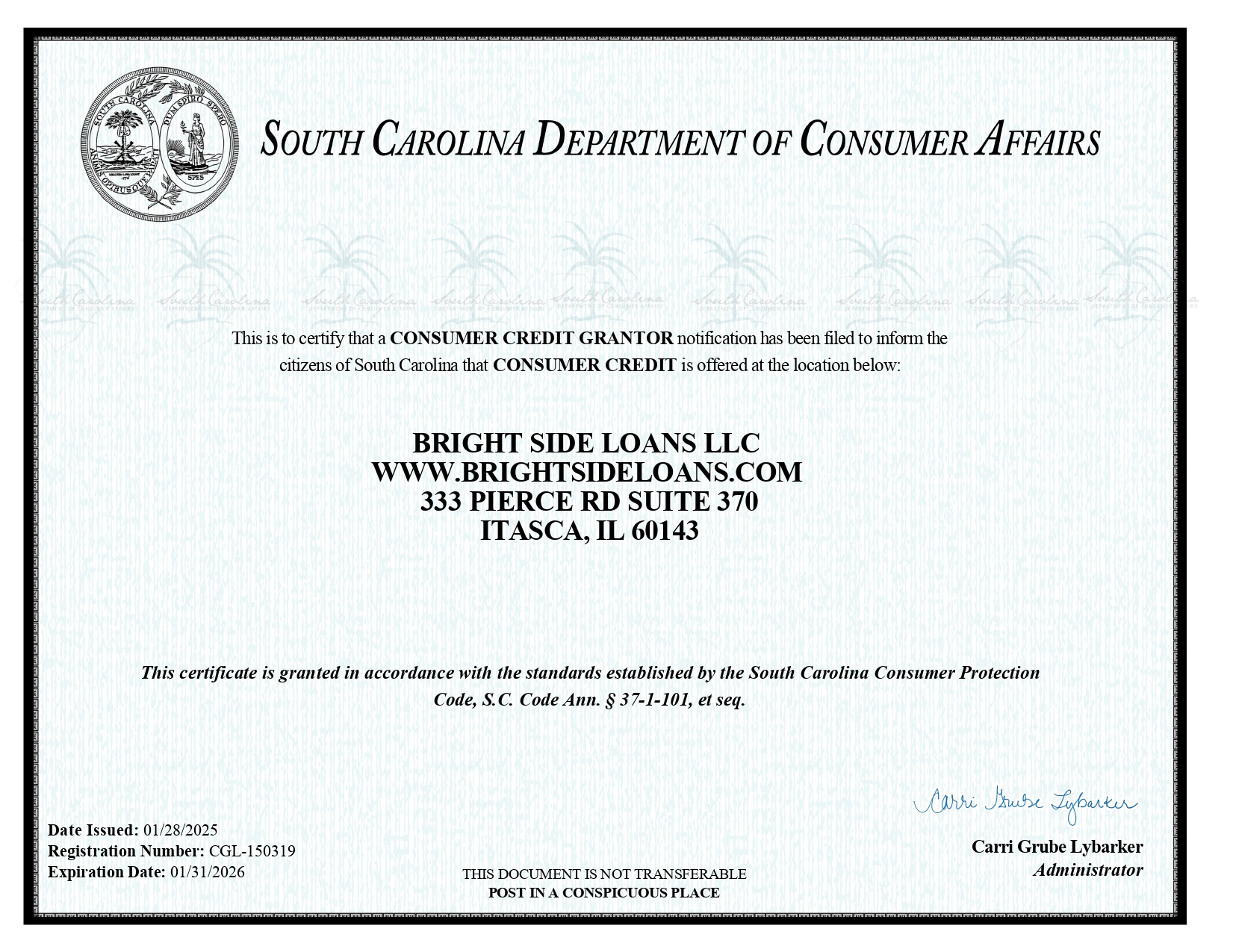

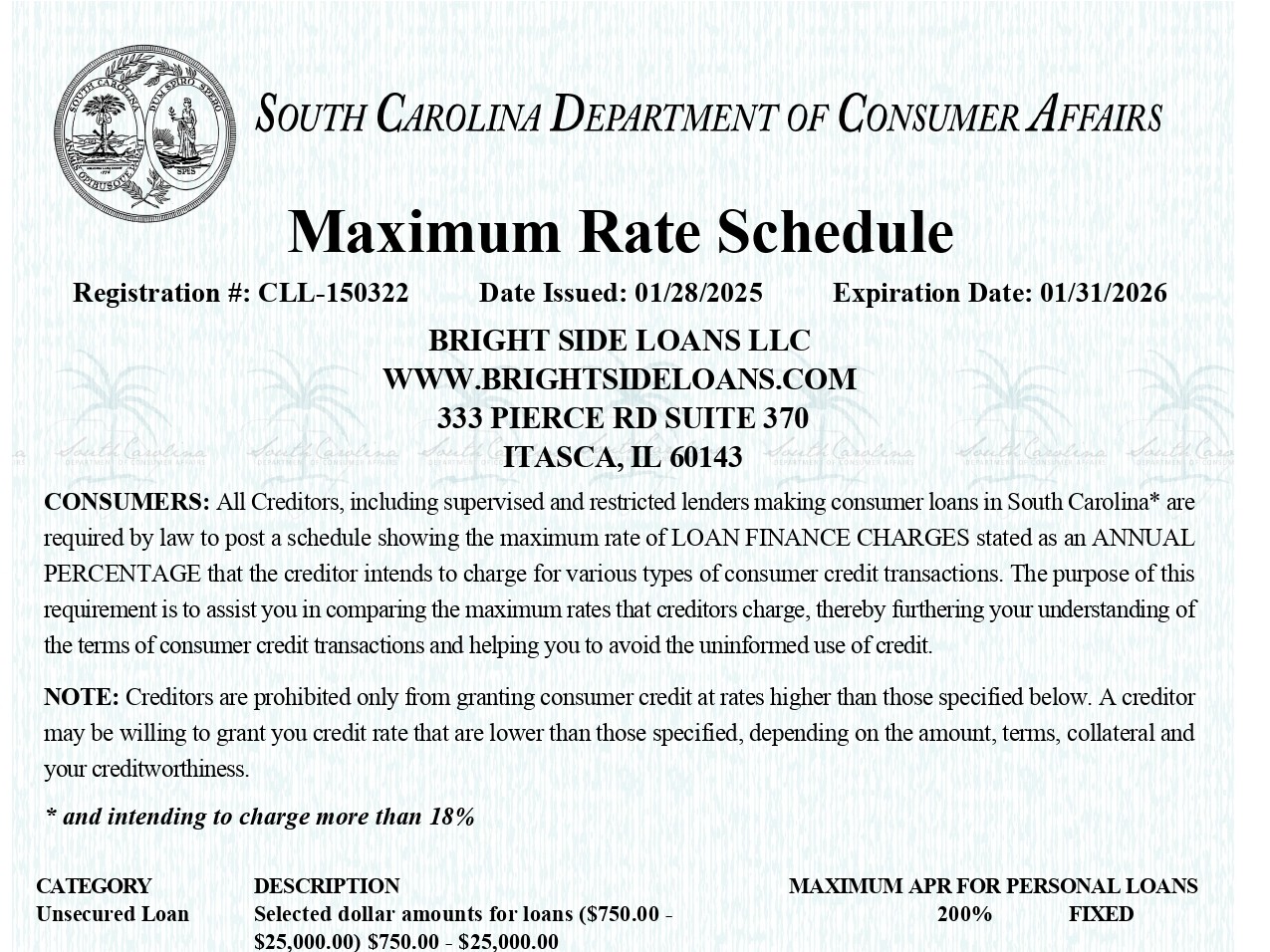

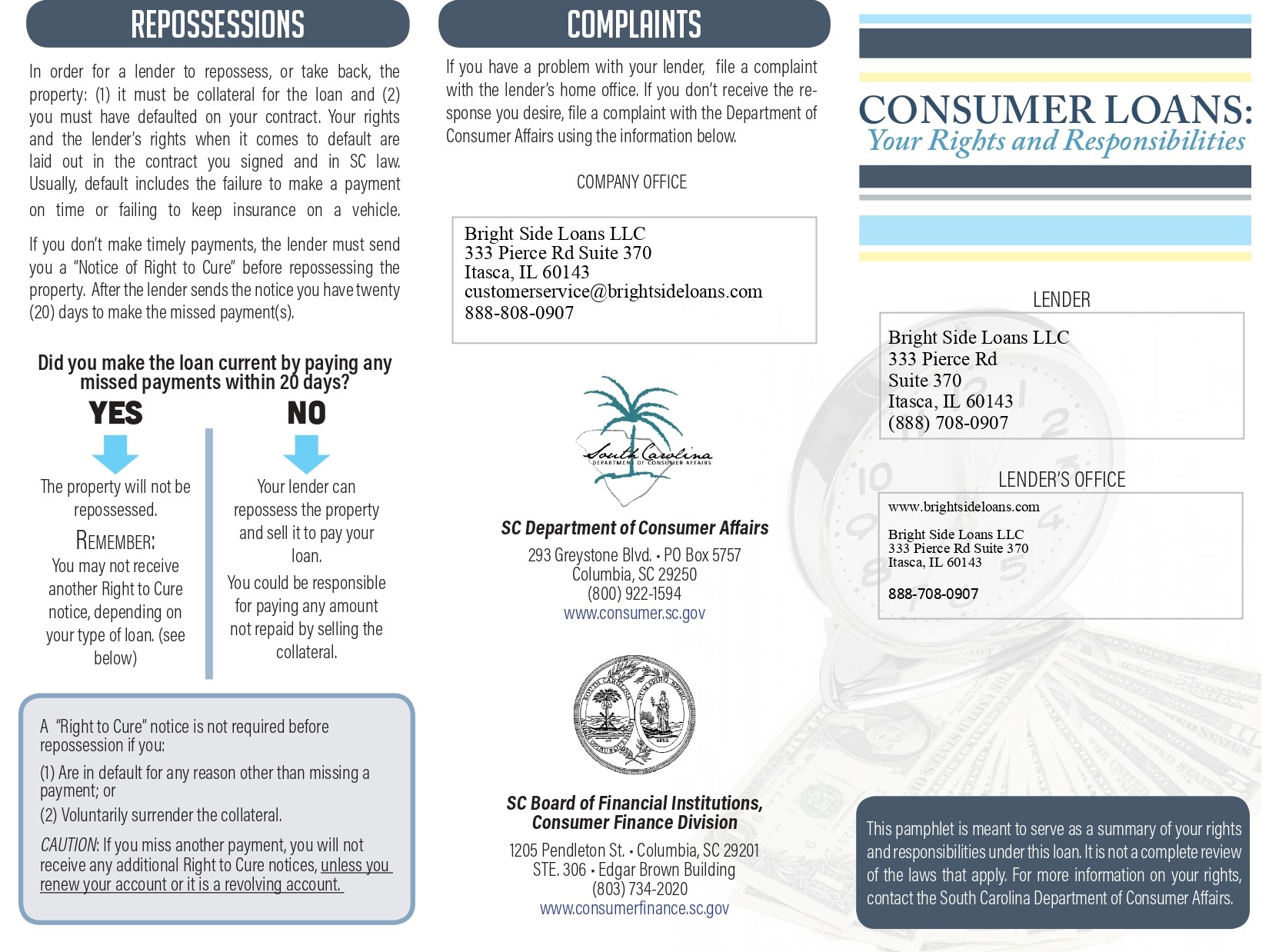

South Carolina

Check out our licenses in the state of South Carolina.

Get Online Installment Loans in South Carolina

An installment loan is a short-term loan, typically 12 months however the term can vary from 6-36 months, that is repaid in fixed installments. When you need some quick cash, an installment loan may be a short-term solution for your needs, and is oftentimes less costly than a payday loan. Our team of loan experts make it easy to secure a personal loan, that is not dependent on your credit score. We will be with you every step of the way, from the application process to ensuring you have a repayment plan that is realistic for you.

South Carolina Installment Loans from Bright Side

Here at Brightside, we offer installment loans to borrowers. Your loan term will vary based on the state you reside in, your credit history, income, and the principal loan amount.

- South Carolina residents can borrow typically between $750-$2,000

- Loan terms are typically 12 months however the term can vary between 6 -36 months

What does the application process look like?

Bright Side Loans provide installment loan services with the ease and convenience of completing the entire process online in the comfort of your home. Bad credit? Don’t worry, we’ve seen it all and work with borrowers of all levels of creditworthiness. Our customer service team can qualify and fund you for a loan in under one business day, and are happy to work with you throughout the entire application and approval process. Here is exactly what you can expect:

-

Complete our simple loan application to determine your eligibility.

Our fully online application will ask you questions about yourself, your employment, and your bank account details. Be sure to fill the application out in full, and consult with our specialists if you are unsure about anything! -

Once you pass our initial credit review, we will ask for a bit more information.

You will need to submit your most recent pay stub, which will be done through our online portal. Next, we will send you a link via text and email that you will use to complete our online bank verification. -

Finalize loan terms.

At this time, we will review your repayment terms and APR, exactly how much your loan payments will be, and the due dates for each of your payments. -

Sign the loan agreement and receive payment in your bank account the next business day!

Once our loan agreement has been completed, your cash advance will hit your checking account the following day. Yep, it really is that easy! -

Loan repayment will begin on your scheduled first payment due date. Our team can help you set up automatic recurring payments to ensure you never miss a payment.

Why are Installment Loans from Bright Side Better?

Our installment loans not only provide you the flexibility you need, when you need it most, but more importantly, you will work with real human beings who are compassionate to your financial needs and unique situations. Yes, our team has an abundance of experience getting borrowers with very bad credit cash when they need it, but our support does not end there.

The Bright Side team continues working with you during the loan repayment process to ensure you are building credit and are able to make your payments on time. You will never encounter unexpected expenses, and our team of experts will make sure you fully understand exactly what to expect during the entire process.

Additional Questions or Concerns? Visit our Page