- 333 Pierce Rd Suite 370, Itasca, IL 60143, United States

- customerservice@brightsideloans.com

- +1 (888) 708-0907

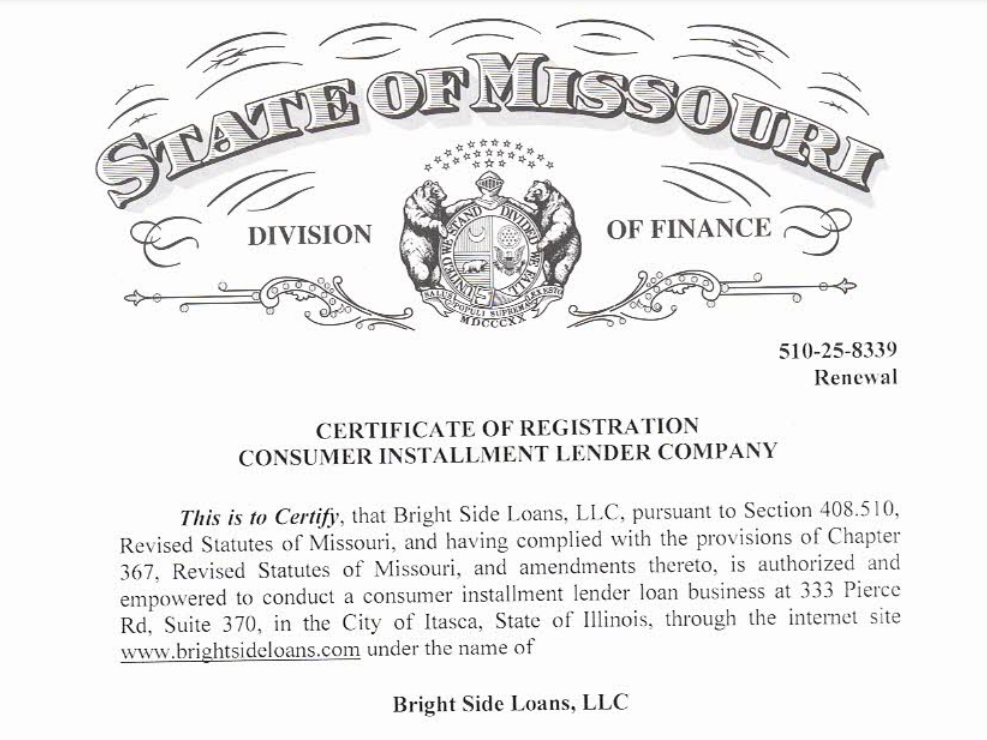

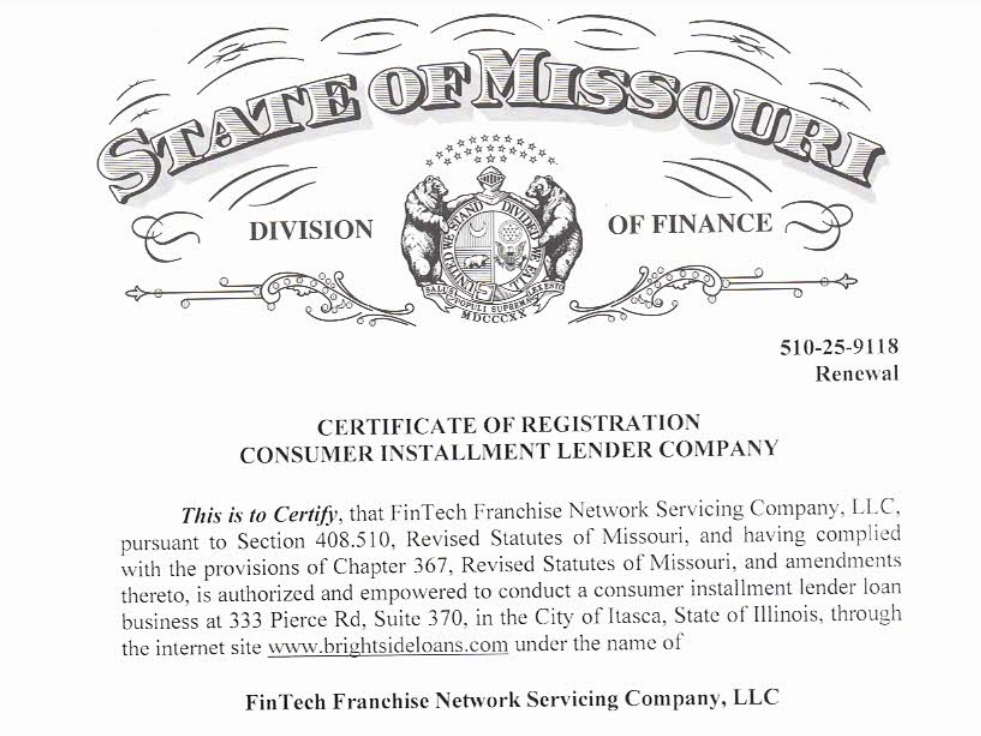

Missouri

Check out our licenses in the state of Missouri.

Get Online Installment Loans in Missouri

An installment loan is a short-term loan typically spanning 6 to 36 months, repaid in fixed intervals.

When you need swift financial relief, an installment loan can be your go-to short-term solution—often proving to be more economical than payday loans.

At BrightSide Loans, our expert team simplifies securing a personal loan, irrespective of your credit history. We stand by you throughout the journey, from the application stage to devising a repayment strategy tailored to your situation.

Missouri Installment Loans by Bright Side

At Brightside, we extend installment loan services to eligible borrowers. The specifics of your loan term are influenced by your residing state, credit history, income, and the primary loan amount.

- Missouri residents can avail loans ranging from $750-$2,000.

- Loan durations span from 6 to 36 months.

- Maximum interest rates do not exceed 199% APR.

How does the application journey unfold?

Bright Side Loans delivers an easy, online-based installment loan application process, which you can comfortably navigate from your home. Concerned about a poor credit score?

Set your worries aside and address your financial needs.

We work with a diverse range of borrowers and credit profiles. Our dedicated customer support aims to determine your loan eligibility within one business day and offers guidance during the entire application and approval journey.

Here’s what the process entails:

-

Start with our user-friendly loan application: Our digital application will request information about your personal details, employment status, and banking credentials. Ensure to furnish complete information, and contact our specialists for any clarifications.

-

Add more details after the preliminary check: After clearing our preliminary credit check, we’ll require a few additional details. This involves uploading your latest pay slip via our secure online portal. Subsequently, you’ll receive a link on your email and mobile for our online bank verification.

-

Lock in your loan terms: During this phase, we’ll break down your repayment terms, APR, loan installment amounts, and the respective due dates.

-

Endorse the loan agreement: Once you approve, you can anticipate the funds in your bank account on the subsequent business day! Post finalizing the loan agreement, your funds will be deposited into your bank account the next day. It’s as seamless as it sounds!

-

Repayments begin at the designated due date: Our squad is ready to assist you in establishing automated recurring payments, ensuring you stay on top of your repayments.

What Makes Bright Side’s Installment Loans Stand Out?

Bright Side Loans provides installment loan services in all of Missouri with the ease and convenience of completing the entire process online in the comfort of your home.

Bright Side’s installment loans don’t just offer financial flexibility during pressing times; they’re paired with a dedicated human touch.

While our seasoned team specializes in assisting borrowers, even with challenging credit histories, our commitment doesn’t cease post-loan sanction. We walk alongside you during the repayment phase, ensuring you fortify your credit score and stay on track with your repayments.

With Bright Side, unforeseen expenses are a thing of the past, and our professionals ensure you’re clued in at every stage of your loan lifecycle.

Additional Questions or Concerns? Visit our Page