- 333 Pierce Rd Suite 370, Itasca, IL 60143, United States

- customerservice@brightsideloans.com

- +1 (888) 708-0907

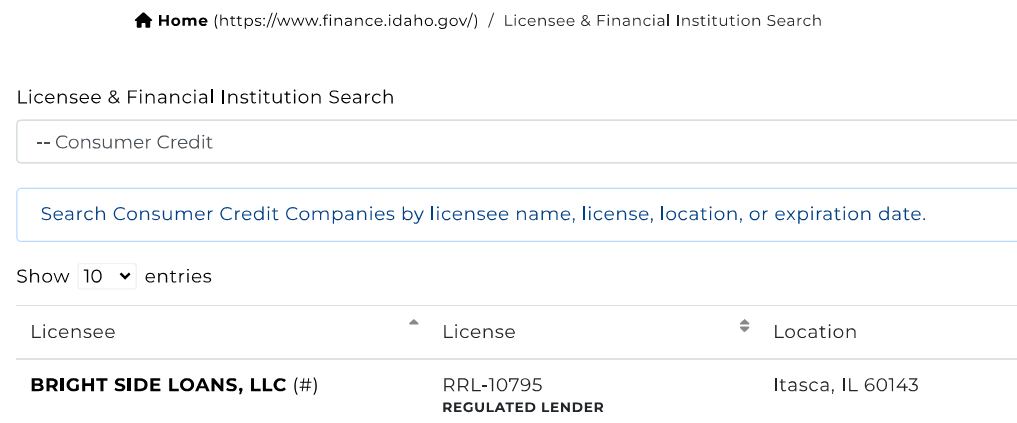

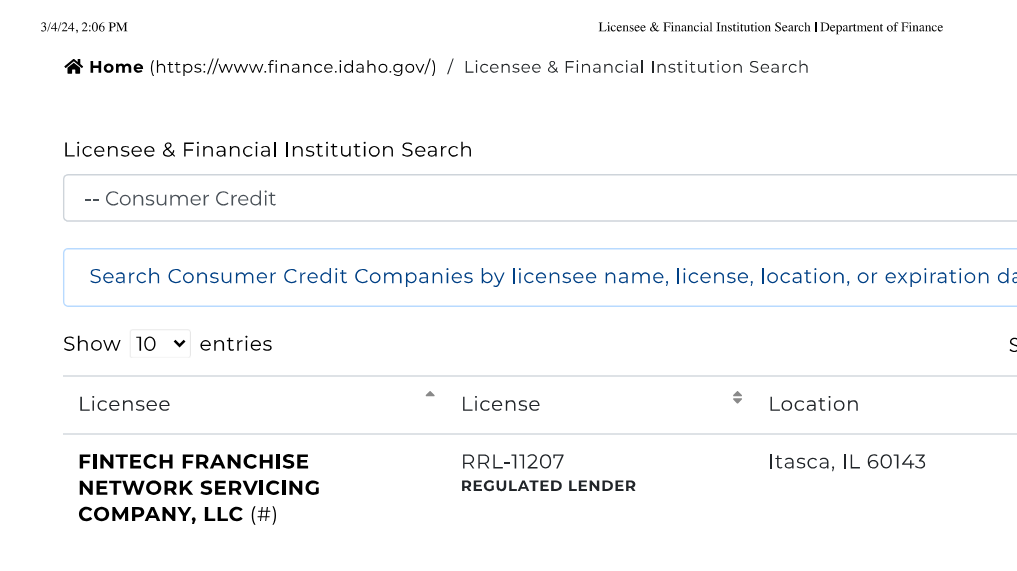

Idaho

Check out our licenses in the state of Idaho.

Get Online Installment Loans in Idaho

An installment loan, typically spanning 6 to 36 months, is repaid in steady intervals.

When unexpected financial challenges arise, an installment loan emerges as a reliable short-term remedy, often being a more cost-effective alternative to payday loans.

With BrightSide Loans, we’ve streamlined the process of procuring a personal loan, regardless of your credit backdrop. From the onset of your application to crafting a customized repayment scheme, we’re at your side every step of the way.

Idaho Installment Loans by Bright Side

Brightside is dedicated to offering installment loan services to prospective borrowers in Idaho. The specifics of your loan term are contingent on factors like your residing state, credit background, income, and the primary loan sum.

- Idaho residents can apply for loans ranging from $750-$2,000.

- The loan span stretches from 6 to 36 months.

Navigating the Application Process

Bright Side Loans champions a streamlined, digital-first installment loan application procedure, ensuring you experience utmost ease right from your living space. Concerned about a poor credit score?

Set your worries aside and address your financial needs.

Catering to a broad spectrum of borrowers and diverse credit scenarios, our attentive customer service aims to gauge your loan suitability within a single business day, guiding you throughout the application and approval journey.

Here’s what the process entails:

-

Start with our intuitive loan application: Our online platform will seek particulars regarding your profile, employment specifics, and banking data. Try to provide exhaustive details and don’t hesitate to connect with our team for any guidance.

-

Further details post initial scrutiny: Once you clear our credit assessment, a few more details come into play. This includes the submission of your recent paycheck via our encrypted online gateway. Soon after, an email and text link will usher you to our online bank verification.

-

Finalize your loan terms: Here, we lay out the details — from repayment conditions, APR, and installment values, to their deadlines.

-

Seal the loan agreement: Upon your nod, anticipate the funds in your bank on the ensuing business day! With the loan contract ratified, you’ll see the funds in your bank by the next day, making the process incredibly efficient.

-

Commence repayments from the agreed-upon date: Our team stands ready to help you set up automated billing, ensuring timely and hassle-free repayments.

What Makes Bright Side’s Installment Loans Stand Out?

Bright Side Loans extends its comprehensive installment loan services throughout Idaho, blending digital ease with the warmth of your home.

Bright Side’s installment loans don’t just offer fiscal respite during crunch times, our installment loans also come with the assurance of a human-centric approach.

Though our adept team is proficient in aiding borrowers, even with intricate credit narratives, our allegiance extends beyond the loan’s sanction. As you navigate the repayment process, we accompany you, striving to enhance your credit health and ensuring you’re always on track.

At Bright Side, unforeseen financial surprises are history, and our seasoned professionals ensure clarity at every juncture of your loan’s tenure.

Additional Questions or Concerns? Visit our Page